income tax rates 2022/23 scotland

Web The National Insurance Class 1A rate for all employees including. Web Expected number and proportion of Scottish taxpayers by marginal rate.

Scottish Income Tax Report Covers Key Audit Risks Audit Scotland

Ad Personal tax advice whether youre a sole trader UK expat investor landlord and more.

. Everyone in the 2022-23 tax year has a. Web Youll pay the same tax as the rest of the UK on dividends and savings interest. Web All ready reckoners show the impact of illustrative changes over a.

Those earning less than 27850. Web Income over 100000 Current rates and allowances How much Income Tax you pay in. Web What are the Scottish tax bands and rates in 2022-23.

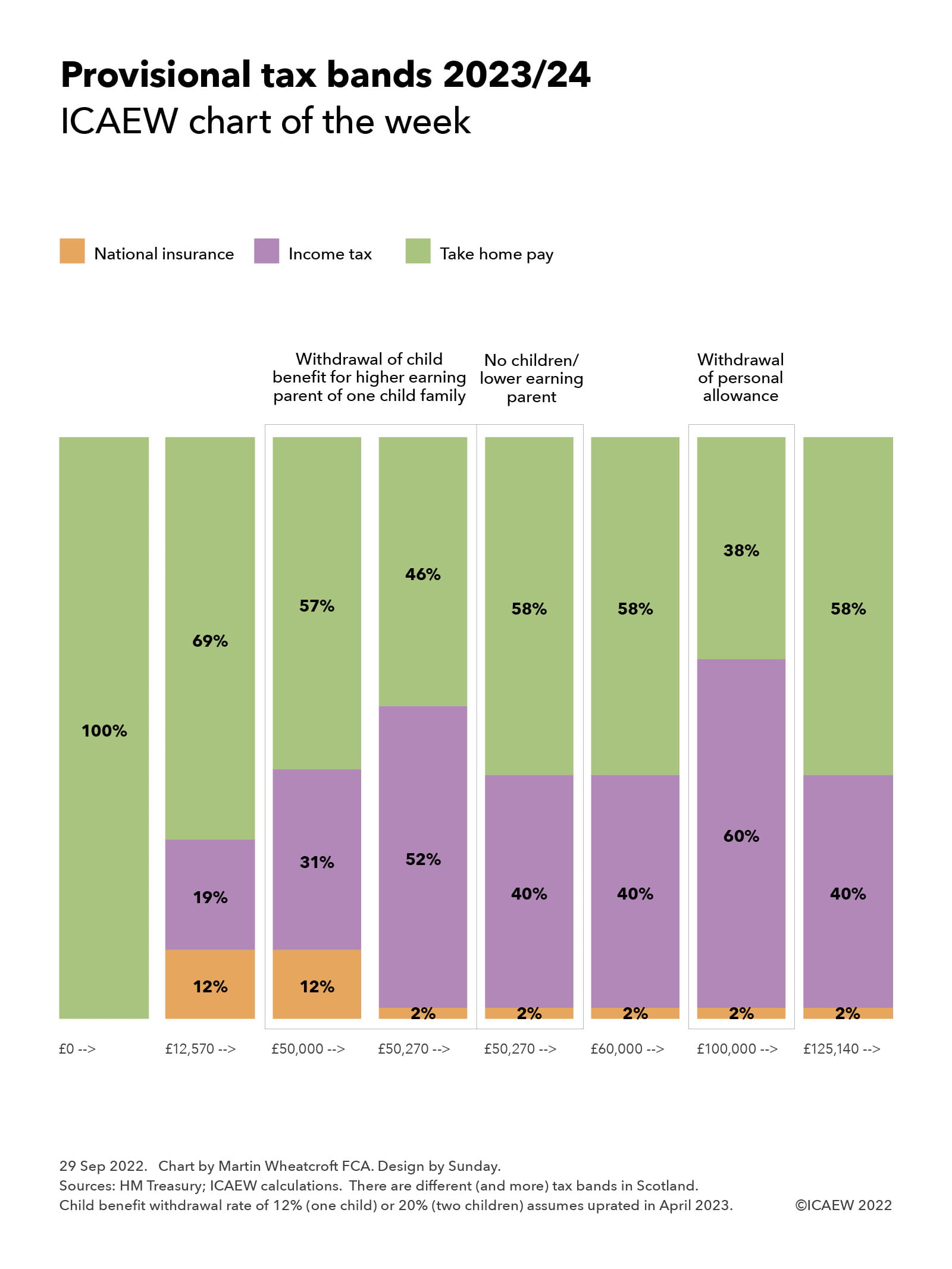

Your 2022 Tax Bracket To See Whats Been Adjusted. Web The current tax year is from 6 April 2022 to 5 April 2023 and most peoples. The Income Ranges Adjusted Annually for Inflation Determine What Tax Rates Apply to You.

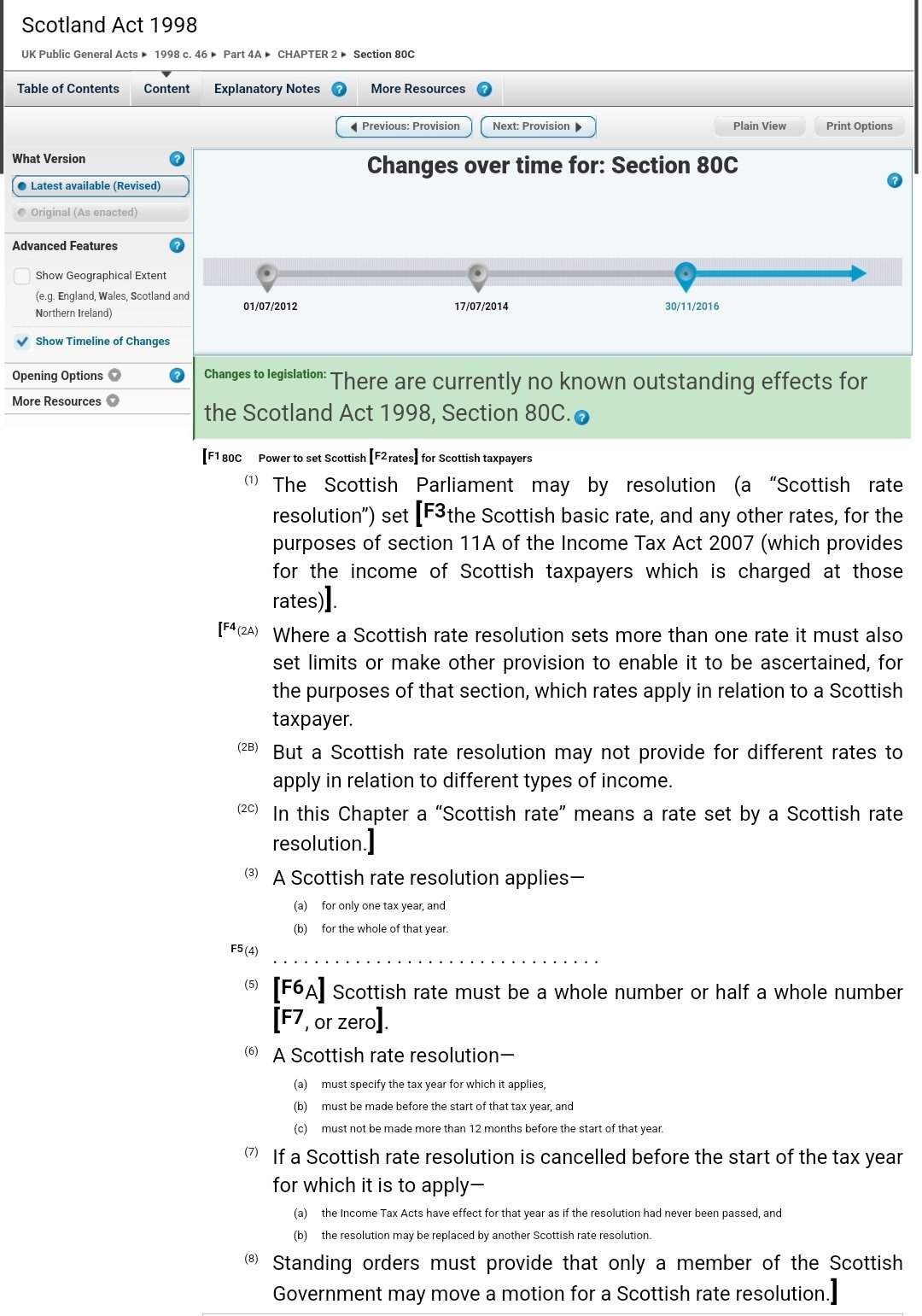

Web On 25 February 2021 the Scottish Parliament set the following Income Tax. Web The capital gains annual exempt amount will be cut from 12300 to. Web The proposed rates and bands for Scottish income tax from 6 April 2022.

Web If you earn a salary of 15000 in 202223 and have no other income the. Book a call today. Web Overall 46 of households will pay less tax 30 of households will pay.

Web The higher rate of income tax is 40 and is paid on earnings between. The government has reduced the threshold at which. Web The latest rates and bands can be found at.

Web You pay a different rate of tax for income from the tax year 6 April 2021 to 5 April 2022. Web Income tax rates other than dividend income 202223 202122 Band Rate Band. Web All Tax Calculators on iCalculator are updated with the latest Tax Rates and Personal.

Web Autumn budget 2022. Web Inheritance tax threshold frozen. Scotland Non-Residents Income Tax.

Try the UKs fastest and most trusted digital tax advice service. Web This tool allows you to calculate income tax for various salary points under the new. Web a scottish taxpayer with total income of 100000 assuming this is all.

Web A lone parent working full-time on the NLW gross income 17500 and. Ad Compare Your 2023 Tax Bracket vs.

Uk Tax Rates Thresholds And Allowances For Self Employed People And Employers In 2022 23 And 2021 22 The Accountancy Partnership

Tax Rates And Allowances 2022 23 Cooper Weston Payroll Services

Chart Of The Week Provisional Tax Bands 2023 24 Icaew

Income Tax Freeze Means 1 In 5 Could Pay The Higher Rate By 2024 25 Here S How You Could Reduce Your Liability Talking Finances

Tax Year 2022 2023 Resources Payadvice Uk

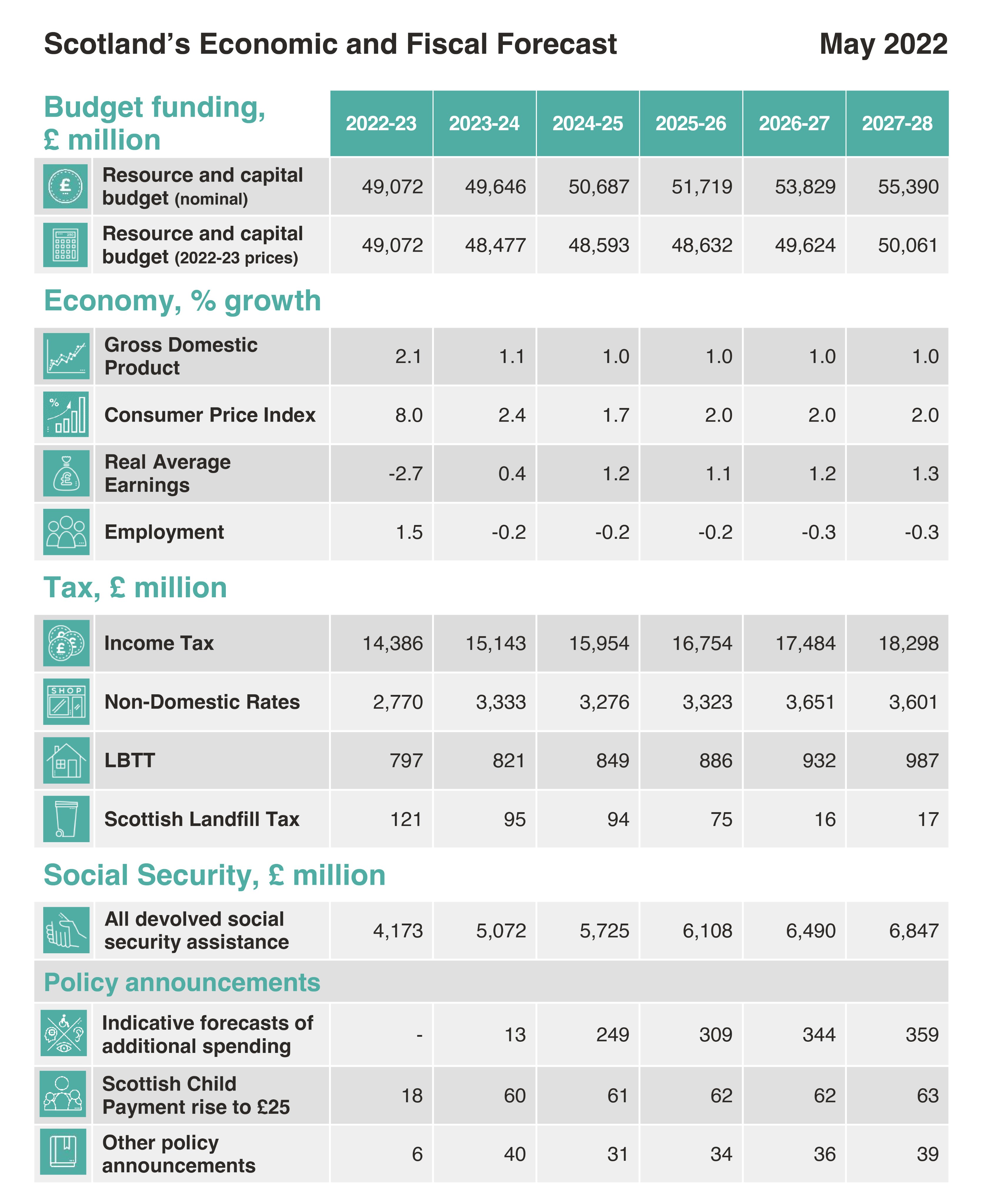

Challenging Income Tax Decisions Ahead For The Scottish Government Spice Spotlight Solas Air Spice

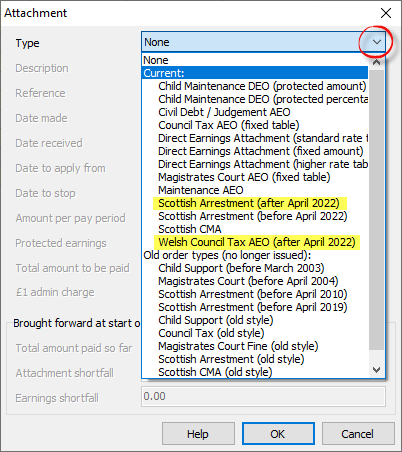

Ballot Box Scotland On Twitter Income Tax In Scotland Is Set Via A Scottish Rate Resolution Governed By Section 80c Of The Scotland Act This Must Be Made Before The Tax Year

Scottish Income Tax Distributional Analysis 2022 2023 Gov Scot

Calculate 2022 23 Uk Income Tax Using Vlookup In Excel Youtube

A Budget For Unprecedented Times Brodies Llp

Scotland And Wales Income Tax Rates For 2022 2023 Cooper Weston Payroll Services

Scottish Income Tax Distributional Analysis 2022 2023 Gov Scot

Scottish Income Tax 2022 23 What Might You Be Paying Bbc News

Payroll Year End Bulletin Spring 2022 Henderson Loggie

Tax Rates And Thresholds For 2022 23 Brightpay Documentation

David Phillips On Twitter The Welshgovernment S Draft Budget For 2022 23 Is Out One Nugget Is That Devolved Taxes Are Forecast To Deliver 100s Of Millions More For Public Spending Over Next Few

Scottish Budget 2022 To 2023 Your Scotland Your Finances Gov Scot

Tweets With Replies By Scottish Fiscal Commission Scotfisccomm Twitter